We actively protect and elevate the legacy of every catalog we acquire. Artists can trust that their work will be represented with care, intention, and cultural relevance.

We deploy capital through SPVs and other flexible vehicles for maximum transparency and control. Investors get direct insight into performance, risk, and return through a private dashboard.

We target evergreen content with strong royalty histories and streaming potential. Each catalog is analyzed for revenue across multiple channels—sync, mechanical, performance, and more.

Artists aren’t just sellers, and investors aren’t just funders. Our Ventureship model is built on collaboration, shared value, and long-term alignment across all stakeholders.

At Loud Capital, Ventureship is more than a capital platform—it’s a partnership model that aligns with modern creators, entrepreneurs, and asset holders. We focus on innovative, revenue-generating opportunities in both digital and tangible sectors.

We invest in digital audio and video catalogs with consistent royalty streams from platforms like Spotify, YouTube, and licensing marketplaces. Our team evaluates and structures acquisitions for long-term income and rights protection.

Loud Capital provides liquidity to creators, athletes, and influencers through investments in endorsement royalty agreements. These deals allow talent to unlock upfront capital while we manage and optimize future cash flows.

We target companies with strong tangible or operational assets. Whether it’s a manufacturing business, logistics operation, or revenue-positive service firm, we focus on unlocking growth through strategic acquisition and operational improvement.

Through Ventureship, we also provide asset-based lending (ABL) solutions for businesses seeking growth capital. We underwrite and lend against assets such as inventory, equipment, receivables, or intellectual property—offering flexible financing where traditional lenders fall short.

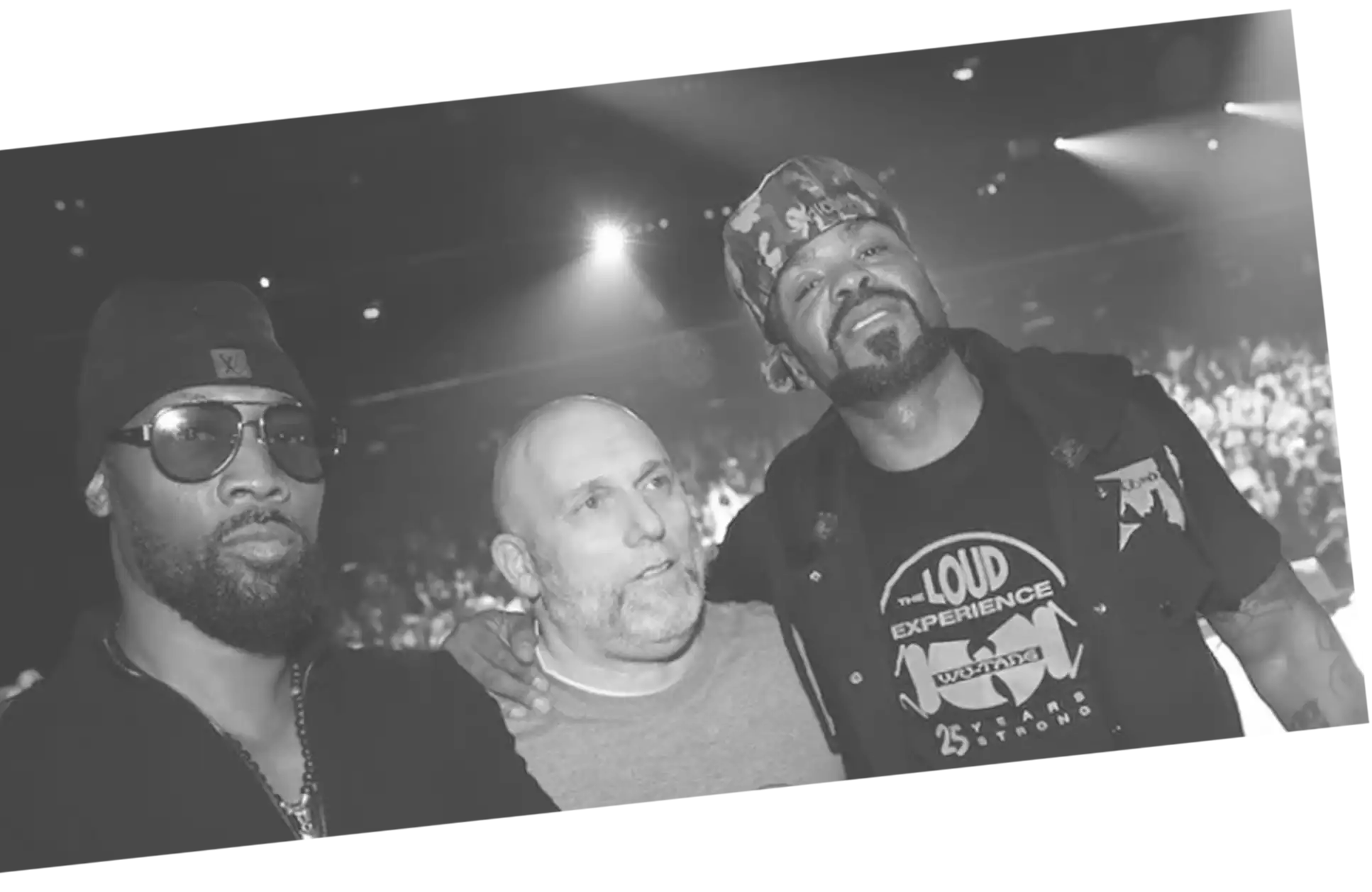

At Loud Capital Group, we deliver a strategic Value Creation Plan for our Limited Partners by leveraging the unmatched industry expertise of Steve Rifkind—an icon in music with deep relationships and a proven ability to elevate talent and intellectual property. When acquiring music catalogs, we take a long-term, hands-on approach to grow asset value by 20–40% over 3–4 years through licensing, global sync placements, brand partnerships, and strategic marketing. More than investment, our mission is to preserve artists’ legacies while creating aligned, win-win partnerships between rights holders and investors—honoring the art while delivering measurable financial upside.

Loud Capital Group enhances its music catalog investment strategy with a proprietary Artificial Intelligence Risk Assessment Calculator, designed to ensure each opportunity is asymmetrical in nature—offering high upside with tightly managed downside. This AI-driven system analyzes market trends, historical performance, rights complexity, and cultural relevance to identify undervalued assets while minimizing exposure to volatility or obsolescence. By integrating this technology, Loud Capital Group adds a layer of intelligent, data-backed protection—preserving capital, amplifying returns, and reinforcing the long-term sustainability of both Limited Partner investments and artist legacies.